abrdn - a global investor with over 800 portfolio managers, analysts and product, risk and trading specialists in over 30 locations worldwide with CHF 581.2 billion in assets under management.

Versatile solutions for versatile challenges

Through active investment strategies, stewardship activities and innovation, we aim to provide investment solutions that help each of our clients optimise their capital. To this end, we offer comprehensive investment solutions across equities, small and mid caps and bonds, as well as multi-asset, real estate, quantitative, private market and alternative investments from developed and emerging markets (Figure 1).

Our core competencies

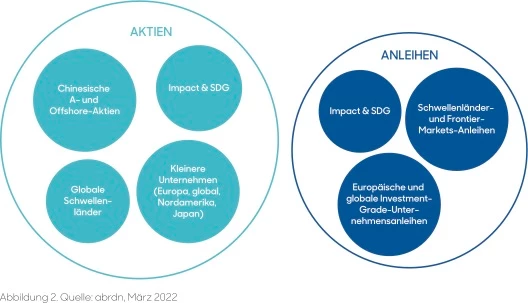

We take an active, research-led and team-based approach to all our equity and fixed income strategies. Among other financial metrics, environmental, social and governance (ESG) factors claim significant attention in our research process. Through this approach, we are able to offer a variety of investment strategies that also meet specific client needs. These include, but are not limited to, the components shown in Figure 2.

To underline our commitment to sustainable client solutions, we have also launched a number of funds that are in line with Articles 8 and 9 of the SFDR and the United Nations Sustainable Development Goals (SDGs). To give you an even better insight, we now introduce you to our North American Smaller Companies team and the opportunities that currently exist in this area.

Small companies - big opportunities: North American Smaller Companies

Although US equity markets were volatile at the beginning of the year, we still see opportunities in the small-cap segment over the long term.

In the past, US small caps have outperformed corresponding large caps, potentially providing long-term investors with attractive capital growth. Such outperformance can help offset the higher risks associated with this equity segment.

In general, small caps have more room for growth due to their size. They are also more flexible than larger companies, as they can adapt more quickly to changing market conditions. Furthermore, the number of analysts covering small caps is lower. This gives active managers better opportunities to find undervalued "gems" that have not yet appeared on the radar of the masses.

Why now?

In our view, the recent bouts of volatility represent opportunities. Earnings expectations for many higher quality small caps remain unchanged. At the turn of the year, the valuation discount of small caps to large caps was the widest it has been in 20 years. This provides active investors with an attractive entry point.

Why invest in smaller companies with abrdn?

You get access to the best investment ideas identified by our North American Equities team. We've been managing small-cap investments for over 30 years, so your investment is in the hands of experienced managers. We invest exclusively in stocks we strongly believe in, no matter where they are found. We invest primarily in quality companies with strong balance sheets that we believe can sustain profitable growth over the longer term. Through this process, we are able to identify the little-noticed smaller companies of today that could be the most successful companies of tomorrow, regardless of current market volatility.

Pierrick Geel is Business Development Manager at abrdn Investments Switzerland AG in Zurich. You can find more information here.