Own funds are a real strategic option for Swiss asset managers.

With the entry into force of the FinIA legislation, every independent asset manager has had to show its colors with regard to its future business orientation - and nota bene about the continuation of its business. The decision to continue business required various follow-up actions, including in particular the notification on FINMA's registration platform as of June 30, 2020. Around 1,900 Swiss asset managers have taken this step and they now form the future core of the supervised "Swiss asset manager community". As a result, these asset managers must now fulfill a number of additional obligations that have been widely discussed in the financial industry. Alongside these uninspiring "have to" discussions, it is lost that FinIA also brings with it a "may" for asset managers. For the first time, Swiss asset managers are allowed to directly manage funds - a privilege that was previously only available to asset managers.

We would now like to talk about this forward-looking topic and demonstrate that the management of own funds is a real strategic option for Swiss asset managers.

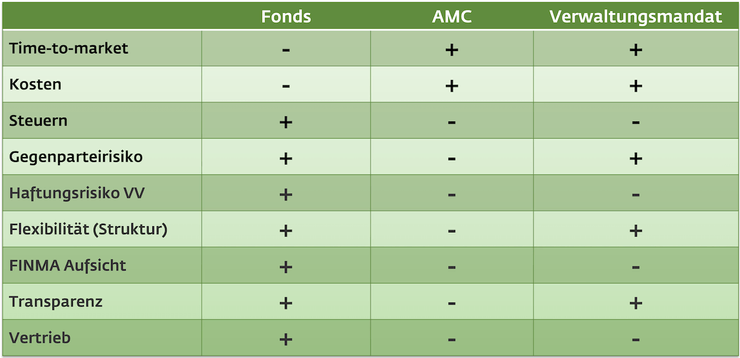

Until now, an independent asset manager has essentially had two instruments in his asset management toolbox: the classic management mandates and AMCs ("Actively Managed Certificates"). While the former represents an individual investment solution and is characterized by great flexibility, the certificate already allows the implementation of a "pooled" investment approach by means of which a specific investment strategy for a majority of investors is implemented in one product. By mapping an investment strategy via a fund, the asset manager now enters a new dimension. Funds are a highly regulated product, which is very flexible in its handling and design, has a high level of cost transparency for the client and represents a great administrative simplification for the asset manager. In the following table, the three asset manager tools are compared along various dimensions in terms of their strengths/weaknesses.

Asset manager toolbox:

Comparison of strengths/weaknesses

Three advantageous aspects of using an own fund in asset management are discussed here.

By means of a fund, an investment strategy (or part of it) can be carried out centrally in one vessel and does not have to be mapped in a multitude of client portfolios and possibly across several custodian banks. This also means that the trading volume for a transaction by the fund at its counterparty is much larger than a large number of transactions at the respective custodian banks of the clients, which leads to more favourable transaction costs. The saved implementation effort can be used by the asset manager for additional client care time or for further acquisition activities.

Funds are also tax-privileged investment vehicles. For example, no stamp duty is payable on transactions by the fund. Likewise, unlike the same activity in a mandate, the asset management fee concerning the fund is exempt from VAT and does not accrue. These aspects work directly in favour of better investment performance for clients.

The fund continues to act as a discretionary wrapper for the investments of asset management clients. This is particularly relevant against the backdrop of the latest European regulation (the Shareholder Rights Directive), which, among other things, provides for an automatic notification procedure by shareholders of European companies if such companies wish to obtain information on the composition of their shareholder base. Even Swiss banks are affected by this reporting obligation and must comply with this requirement. In the case of a fund, however, it is not the individual but the fund that is reported as a "shareholder".

What is the procedure to establish such a fund? The primary prerequisite is the registration of the asset manager with a supervisory organization under fulfillment of all new "FinIA-requirements". As soon as the corresponding confirmation of the supervisory organization has been received, the asset manager can submit his dossier to FINMA.

In parallel - at the product level - the asset manager develops his fund together with his chosen fund management company. As soon as the necessary fund documents (e.g. fund prospectus) have been drawn up, the "fund dossier" can be submitted to FINMA for approval at the same time as the "asset manager dossier". LLB Swiss Investment AG is convinced that funds are an option worth considering in the asset management of independent asset managers. We are already accompanying two asset managers on this path and expect a large number of such initiatives in 2021. We would be happy to advise asset managers on the possibilities and exact procedure without obligation.

About LLB Swiss Investment AG

LLB Swiss Investment AG is the Swiss fund management company within the LLB Group and manages over 50 funds under Swiss law. For 25 years, it has set up all types of securities funds and assumed responsibility for fund administration. The company distinguishes itself through tailor-made and efficient services and attaches great importance to being close to its clients. These are discerning asset managers, family offices and banks that depend on reliable, flexible and prompt service. LLB Swiss Investment AG pursues an open approach with regard to the custodian bank function and leaves it up to the clients to determine the custodian bank that suits them best.